Stocks tumble again as US hits China with 104% tariffs

Most Asian stocks on Wednesday after US President Donald Trump's eye-watering 104% tariffs on China took effect, while a savage selloff in Treasuries sparked fears foreign funds were fleeing U.S. assets.

The U.S. dollar fell against safe-haven currencies, but the onshore yuan hovered just above the lowest level since late 2007 as Beijing allowed the currency to depreciate further amid the sharp escalation in the trade war with U.S.

Few assets were spared the recession fears engulfing markets, with oil prices diving almost 4%.

The pain is likely to spread to Europe too, with EUROSTOXX 50 futures pointing to a 3.7% drop upon open. Both S&P 500 futures and Nasdaq futures dropped 1.6%.

Overnight, Washington confirmed 104% duties on imports from China would take effect at 12:01 a.m. Eastern Time (0401 GMT), as planned. That deadline passed without new developments on trade.

"U.S. and China are stuck in an unprecedented, and expensive, game of chicken, and it seems that both sides are unwilling to back down," said Ting Lu, chief China economist at Nomura.

"Given the extraordinarily fluid situation, it is impossible to reasonably estimate the impact of the ongoing U.S.-China trade war on China’s economy."

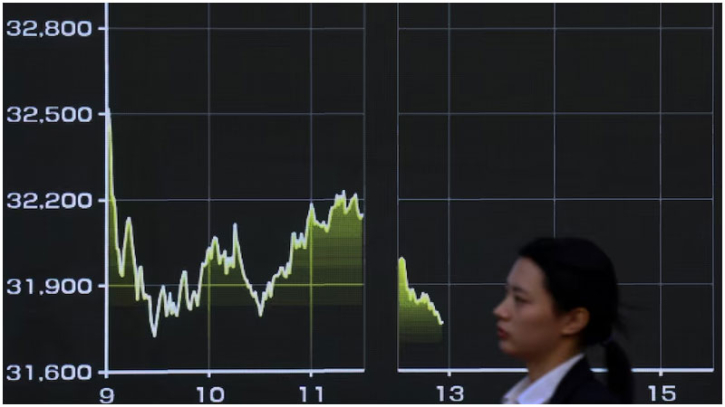

The shifting headlines on tariffs and the spectre of a prolonged trade war between the world's two biggest economies sparked sharp volatility in financial markets.

The S&P 500 was swept up in one of the biggest reversals in at least the last 50 years, with the benchmark index losing 4.2 percentage points from a positive start to a negative finish. The index has lost $5.8 trillion in stock market value, the deepest four-day loss since it was created in the 1950s.

.png)