Bangladesh govt raises savings rates to cool inflation, woo investors

The interim government of Bangladesh has increased interest rates on various national savings certificates to upwards of 12% in an effort to make these instruments more attractive to savers and to cool inflation.

The finance ministry issued a circular on Wednesday regarding the interest rate hike on savings tools. The new rates will be effective from January 1, according to the circular.

The move comes in face of falling revenue collection, plummeting foreign funds and higher debt servicing pressure, prompting the government to look for money to meet the overall expenditure.

The rise in interest rates will offer some relief to fixed-income groups, whose earnings have been squeezed by elevated inflation for about two years.

However, previous investors will continue to receive interest based on the earlier rates.

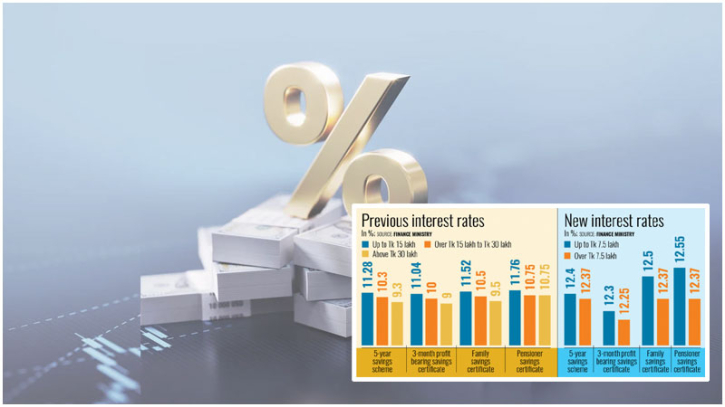

Previously, interest rates on the four savings certificates offered by the Department of National Savings ranged from 11.04% to 11.76%.

The interest rates will now be set according to the weighted average interest rates of five-year and two-year treasury bonds. Every six months, the savings certificate rates will be adjusted after reviewing these treasury bond interest rates.

Investors will receive interest based on the rate applicable during their investment period.

Additionally, a premium of up to 50 basis points will be added to the weighted average treasury bond interest rates when setting savings certificate rates, according to a finance ministry source.

The savings instruments include the five-year Bangladesh savings certificate, the three-monthly profit-bearing Sanchayapatra, the five-year family savings certificate and the five-year pensioners' savings certificate.

Currently, there are three different interest ceilings for these four savings certificates.

Under the new system, the interest rate on the five-year Bangladesh savings certificate will be 12.4% for investments up to Tk 7.5 lakh. For savings above Tk 7.5 lakh, the interest rate will be 12.37%.

Currently, a saver receives 11.28% interest for investments up to Tk 15 lakh after maturity, 10.30% for investments between Tk 15 lakh and Tk 30 lakh, and 9.3% for investments above Tk 30 lakh.

In the case of the three-monthly profit-bearing Sanchayapatra, the new interest rate will be 12.3% to 12.25%. Currently, the interest rates are 11.04% to 9%.

Professor Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue (CPD), said the interest rate hike will, on one hand, increase the government's loan repayment burden.

On the other hand, he said, it will make it more difficult for the private sector to get loans from the banking sector.

"People may keep their funds in the banking sector. But it may not flow to private players. Rather, it will flow to the government," Rahman said.

"As the non-bank financial institutions [NBFIs] were offering higher interest rates, people earlier were not encouraged to invest funds in the savings tools," he said.

The economist noted that the government has taken this decision as an inflation control measure, which aligns with its contractionary monetary policy.

At the same time, it will also provide the government with more liquidity to cover its expenditures, he added.

For the family savings instrument, the new interest rates will range from 12.5% to 12.37% while the existing interest rates range from 11.5% to 9.5%.

Similarly, the interest rates on the pensioners' scheme will be 12.55% to 12.37% under the new rates. At present, these rates range from 11.76% to 9.75%.

Meanwhile, interest rates on other savings instruments -- the wage earners' bond, the US dollar investment bond and the US dollar premium bond -- will remain unchanged.

The interest rate on post office term deposits ranges from 12.30% to 12.25%.

Govt in search of Money

During the July-September period of fiscal 2024-25, the total sale of national savings tools amounted to Tk 14,991.95 crore, which was 30.77% lower compared to the same period of previous year.

During the first quarter of FY25, total repayment of the tools decreased by 70.95% to Tk 6,659.15 crore compared to the same period of previous fiscal year.

Therefore, the net sale of savings tools during the July-September months of FY25 increased substantially by 758.74% year-on-year, resulting in a net sale of Tk 8,332.80 crore.

Revenue collection in the July-November period was down by 2.62% compared to the corresponding period of the previous year.

Bangladesh got $1.54 billion in the July-November period of the current fiscal year, which is 27% lower than the corresponding period last year.

Meanwhile, the country's debt servicing surged by more than 28% to $1.71 billion during the period.

These figures indicate that the government's pool of funds was drying up, prompting the authorities to look for liquidity to cover overall expenditures.

.png)