The Trump tariffs: Balancing act or blunder?

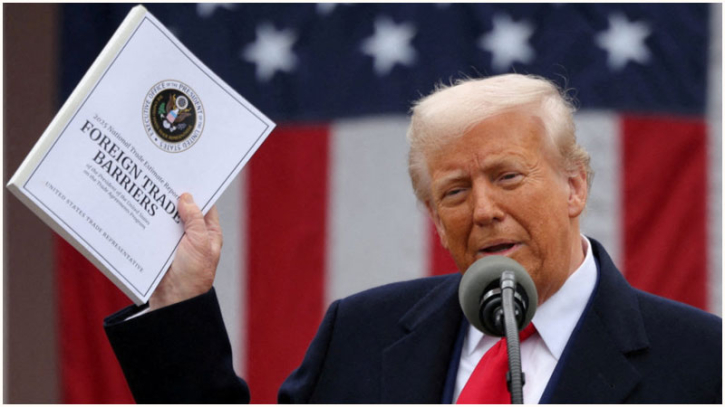

President Trump's flamboyant justification for imposing reciprocal tariffs on US trading partners exemplifies an argument that defies resolution—it cannot be conclusively proven or disproven. Trump's stance is rooted in his belief, and the only verifiable aspect of this belief is that US import tariffs are generally lower than the tariffs faced by US exports globally. Beyond this, Trump's tariff policies resist logical coherence.

Historically, US trade negotiators prioritized balanced market access over tariff equalization. From the 1940s to the 1990s, when the United States, European nations, and others negotiated tariff reductions, the resulting market access was balanced, though final tariffs varied by product. Trump, however, characterizes this historical arrangement as a "rip-off" of the US by other nations.

International tariff disparities

Global tariff disparities arise from differing tariff levels and structures across countries and products. Beyond tariffs, trade barriers manifest in forms such as quantitative restrictions, subsidies, technical barriers, and administrative procedures, creating uneven trade conditions and potential imbalances.

For decades, global trade adhered to tariff agreements established by the US and 122 other countries during the 1980s and 1990s. On 2 April, Trump dismantled this framework, claiming that other nations had exploited the system to the detriment of the US, leading to the decline of its manufacturing sector.

Before this upheaval, two-thirds of global trade was tariff-free, though high tariffs persisted in agriculture and manufacturing. Trump's February Reciprocal Trade and Tariffs Memorandum underscored tariff disparities, though these differences were often less pronounced than perceived—for example, the EU's 5% average tariff on US goods compared to the US's 3.4% on EU goods.

Upon taking office, Trump issued the America First Trade Policy Memorandum, initiating a review of US trade policy and introducing a new tariff regime. By February, he had imposed duties on nearly half a trillion dollars' worth of imports, doubled tariffs on China, and repeatedly announced and suspended 25% tariffs on Canada and Mexico. This culminated in a regime of reciprocal tariffs.

Deficit = Cheating (unless it's the US)

Trump's approach to reciprocal tariffs resembles an elastic measuring tape—its units shift to suit the measurer's preferences. The premise is simple: any country running a bilateral trade surplus with the US is deemed to be cheating, necessitating reciprocal tariffs to "level the playing field."

To justify this, the Trump administration identified various ways countries interfere in trade—tariffs, para-tariffs, non-tariff barriers, sweatshops, and currency manipulation—and calculated a proxy for the total "tariff" each country imposes on the US The US bilateral trade deficit was framed as the excess "ripped off" by countries selling more to the US than they buy. This excess, it is claimed, is used to acquire US real and financial assets—a supposed "sellout."

The proxy for the combined excess tariff rate was calculated by dividing the US trade deficit with a country by the value of goods exported to the US A 50% discount was then applied to this rate, as a gesture of kindness, adding the other 50% to the pre-existing tariff rate to "Make America Wealthy Again." Since the trade deficit persisted despite existing tariffs, the reciprocal tariff was added on top—akin to deploying reinforcements. For example, in Bangladesh's case, the effective tariff rate rose from 15% to 52%, with a 37% reciprocal tariff added.

This formula works when the US has a trade deficit with a country. However, it fails to justify additional tariffs in cases where the US enjoys a trade surplus, such as with Australia, Argentina, and the UK. To address this, a new condition was introduced: countries running a trade deficit with the US would face a minimum 10% tariff. Concerns about how this might inflate the US's own excess tariff rate are conveniently ignored.

If all trade deficits signify cheating, then by Trump's logic, the US must also be guilty. Yet, the administration insists that only other countries cheat. Bilateral trade surpluses with the US are attributed to unfair trade practices—except when it comes to the US, whose surpluses are credited to superior cost and quality competitiveness.

When asked what sets the US apart, the answer boiled down to "why not?" Services like tourism, education, and business services (e.g., Netflix), where the US runs a surplus, are excluded from the equation. Why? Again, the answer is simply "why not?"

Trade economics 101

Trade deficits arise from differences in savings and investment. Unless the US isolates itself entirely from international trade or resorts to barter-only exchanges, bilateral trade imbalances are inevitable—even if national trade is balanced. Like any other country, the US would still run deficits with some nations and surpluses with others. Surpluses might be used to acquire assets in surplus-generating countries or to offset deficits with others.

The US remains a top investment destination, but its low private savings rate and significant government budget deficits complicate matters. Trump's April 4 post highlights the contradictions in his policy: "To the many investors coming into the United States and investing massive amounts of money, my policies will never change. This is a great time to get rich, richer than ever before!!!" While this may attract investment, it inevitably increases the US trade deficit.

You don't need to be an economist to understand that bilateral trade imbalances are a natural part of commerce. Everyday experiences illustrate this: you sell your services to your employer, creating a trade deficit for them. The employer, in turn, generates a surplus by selling to customers. You then spend your earnings at a grocery store, creating a trade deficit with the grocer, who balances it with their surplus from customers. These imbalances are interconnected and don't require cheating to exist.

Schizophrenia in US trade policy

Traditional conservatives have viewed tariffs as temporary tools to secure concessions from trading partners, with the expectation that they would be removed once negotiations succeeded. Trump, however, sees tariffs as a permanent revenue source and a long-term incentive for reshoring production. The mobility of factories entrenches these tariffs, removing them from broader negotiations because they have to stay for factories to stay.

While Trump has left room for renegotiation with his "I give if you give" approach, this implies that additional tariffs are temporary. But what happens to relocated factories if reciprocal tariffs are reduced or eliminated? Trump seems to believe they'll remain in the US, despite the possibility of returning to cheaper locations. The administration assumes that the rest of the world shares its beliefs, or they must.

If this isn't policy schizophrenia, what is?

Market verdict

Markets have reacted sharply, with uncertainty about future trajectories. Chinese retaliation has amplified fears. Trump's "Liberation Day" triggered the largest US stock market rout since the COVID-19 crash in 2020, shaking global sentiment. Growth expectations have plummeted, and recession risks have surged. Traders, caught off guard by the scale of tariffs, shifted from equities to safe havens like bonds. This week, the S&P 500 fell over 9%, following a 17.4% drop, while the Dow Jones declined 14.9%, both from their recent peaks. The Nasdaq Composite fared worst, retreating 22.7%.

Investors hoped Federal Reserve Chair Jerome Powell would provide reassurance, but on Friday, he warned that the economic impact of tariffs could be greater than anticipated. He added that the Fed would adopt a wait-and-see approach on interest rates.

Source: The Businsess Standard.

.png)