Sri Lanka's China ‘debt trap' fears grow as Beijing keeps investing

Surging Chinese investment including a multibillion dollar oil project late 2023, is leaving a giant question mark over Sri Lanka even as it tries to restructure towering debt and recover from its worst economic crisis as an independent nation: Just how much leverage does Beijing have over the island country?

China is the largest bilateral creditor to the Island nation, which in May 2022 became the first Asian lower-middle income country to default on its sovereign debt in two decades. Chinese loans had financed a string of large infrastructure projects, including highways, an airport and a port in the country.

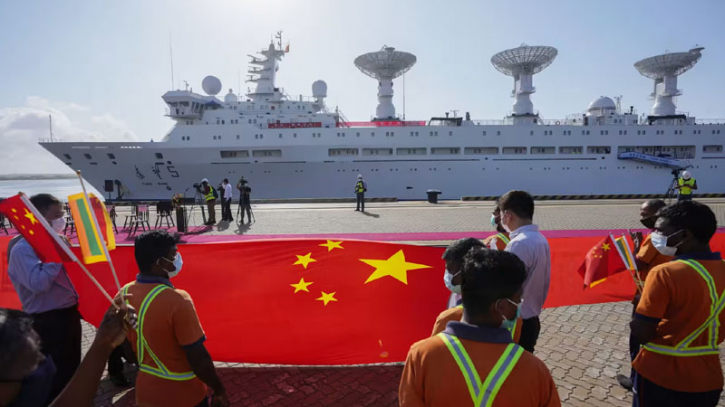

Sri Lanka's debt has been soaring since 2009, as the government embarked on a borrowing-financed endeavor to enhance the country's infrastructure as it emerged from civil war. A supporter of China's giant infrastructure Belt and Road Initiative (BRI) from as early as 2013, Sri Lanka has frequently been depicted by China critics as falling into an alleged Chinese ‘debt trap,’ enticed into accepting unsustainable loans for infrastructure projects and allowing Beijing to gain strategic or military influence by seizing assets in times of financial distress.

China has repeatedly denounced claims that it is operating a debt trap. "We have never forced any party to borrow money or pressed any country to accept debt. We do not attach any political conditions to the loan agreements and do not seek any political self-interest," a Chinese Foreign Ministry spokesperson said last year.

While China has indicated its readiness to restructure Sri Lanka's $36.4 billion in outstanding foreign loans, it is also extending direct investment in the country.

In late November, Sri Lanka approved Chinese state-owned oil giant Sinopec's proposal to build a $4.5 billon refinery in the southern port of Hambantota, the single largest investment in Sri Lanka since the economic crisis of 2022. The approval came after commodities trader Vitol, the only other shortlisted bidder, dropped out.

"If successfully done, this investment can help Sri Lanka in the long run," said Toshiro Nishizawa, a professor at the Graduate School of Public Policy of University of Tokyo, referring to the country's problems with fuel shortages. In addition, "It could be crucial leverage for Beijing in China's access to Sri Lanka's economy."

That is because Sri Lanka's sole oil refinery, built in 1969 by the state-owned Ceylon Petroleum Corporation (CPC), has been struggling to meet domestic demand as economic growth in the island of 22 million people surged before the crisis hit.

Over the years, there have been plans to expand Sri Lanka's refining capacity to reduce its reliance on imported fuel. These efforts have attracted potential investors from China, the U.S. and India. Colombo is trying to take balancing measures by seeking other partners, particularly India, to "hedge the risk of China's over-dominance and [to] seek to maintain its bargaining power with major partners," said Nishizawa.

India and the U.S. are already moving in to counter Chinese influence. Early in November, the U.S. announced it would lend $553 million for the development of a container terminal in Colombo operated by Indian tycoon Gautam Adani.

Wrier: CISSY ZHOU

Source: Nikkei Asia.

.png)