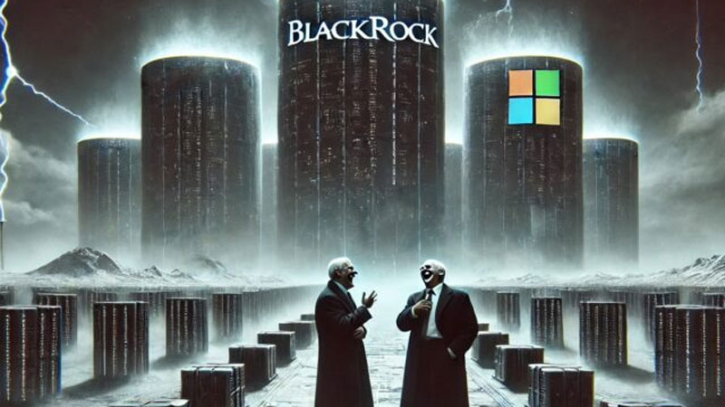

BlackRock and Microsoft plan $30bn fund to invest in AI infrastructure

BlackRock is preparing to launch a more than $30 billion artificial intelligence (AI) investment fund with technology giant Microsoft to build data centres and energy projects to meet growing demands stemming from AI, people briefed about the matter said.

The fund, which BlackRock is launching with its new infrastructure investment unit, Global Infrastructure Partners, would be one of the biggest investment vehicles ever raised on Wall Street. Microsoft and MGX, the Abu Dhabi-backed investment company, are general partners in the fund. Nvidia, the fast-growing chipmaker, was providing expertise, the people said.

The investment vehicle is aimed at addressing the staggering power and digital infrastructure demands of building AI products that are expected to face severe capacity bottlenecks in coming years, according to people briefed about the matter.

The computing power of AI requires far more energy than previous technological innovations and has strained existing energy infrastructure.

The fund would mark GIP’s first big fund since the private infrastructure investment group agreed to be acquired by BlackRock for $12.5bn earlier this year. That deal is due to close in October.

BlackRock, the world’s largest money manager, has highlighted the energy sector as one of its top opportunities for growth. Chief executive Larry Fink wrote to investors earlier this year, that “in my nearly 50 years in finance, I’ve never seen more demand for energy infrastructure”.

The soon-to-be launched fund is the latest vehicle created by a large asset manager to meet the ever-growing demand for energy to power generative AI and cloud computing. Earlier this year Microsoft agreed to back $10bn in renewable electricity projects built by Canada’s Brookfield Asset Management. Microsoft has made a commitment to ensure 100 per cent of its energy consumption is matched by zero carbon energy purchases by 2030.

“The country and the world are going to need more capital investment to accelerate the development of the AI infrastructure needed. This kind of effort is an important step,” said Brad Smith, Microsoft’s president.

In 2017, Blackstone announced plans for a $40bn infrastructure vehicle with backing from Saudi Arabia, and Brookfield last year raised $28bn for what was described as the largest ever infrastructure fund.

The International Energy Agency estimates that global electricity consumption by data centres could surpass 1,000 terawatt-hours by 2026, more than twice the amount used in 2022.

In the US, which hosts one-third of the world’s data centres, electricity demand is rising rapidly for the first time in two decades, driven partly by these energy-intensive facilities. A report from Grid Strategies indicates that five-year projections for electricity demand growth in the US have nearly doubled over the past year, increasing from 2.6 per cent to 4.7 per cent.

Nvidia and MGX did not immediately respond to requests for comment. BlackRock declined to comment.

.png)